15 Electric Car (EV) Stocks to Buy in 2021

Are you looking for the best EV stocks to buy? There’s a fortune to be made as we begin the long process of replacing ICE (internal combustion engine) vehicles with their electric counterpart.

EV stocks are set to explode once more consumers embrace this new technology and shift towards eco-friendly cars, trucks, and SUVs.

The Shift from ICE to EVs Are Long Overdue

The truth is the EV shift will happen because ICE technology is extremely outdated.

The first commercially successful internal combustion engine was created by Étienne Lenoir around 1860.

That’s over 150 years ago!

For centuries, consumers drove gas guzzling vehicles because it was the norm.

Gas powered car technology is over 150 years old and needs to be replaced with more environmentally friendly electric powered vehicles.

Why Invest in Electric Vehicle (EV) Stocks?

Governments from all over the world want its citizens to embrace clean energy vehicles.

EVs fight climate change by reducing carbon emissions that pollute our air and lower quality of life.

Electric cars maintain their value longer, require less maintenance, and cost less money to charge.

The EV explosion is just beginning and there are a lot of new, exciting companies that will take market share from legacy automakers like Ford, General Motors, and Toyota.

In the future, governments will pass mandates to force consumers to drive electric vehicles.

Thus electric car makers will earn massive revenue and see their stock prices soar.

EV Sales Will Skyrocket This Decade

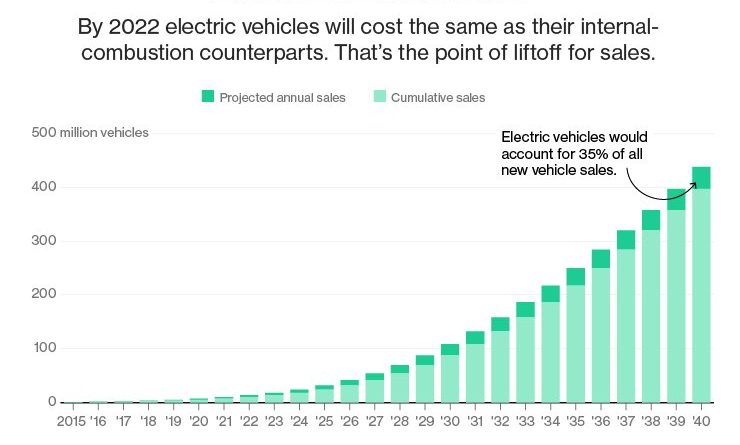

Here’s a graph showing the projected growth of EVs in 2040:

Source: Bloomberg.com

Source: Bloomberg.com

We’re currently in the early stages of the EV boom and there are dozens of great EV stocks to buy as more people choose electric vehicles over legacy ICE vehicles.

It seems like a new EV SPAC launches every week so it’s difficult to keep track of all these EV stocks.

Below is a list of the best EV stocks to buy in 2021 for savvy investors. I’ve included my analysis covering some of the best electric car stocks to buy right now.

I excluded EV charging station stocks from this list because they don’t actually produce any vehicles.

Best Electric Car Stocks

Here’s a list of the best EV stocks to buy right now:

- Tesla (NASDAQ: TSLA)

- Nio (NASDAQ: NIO)

- Xpeng (NYSE: XPEV)

- BYD (OTC: BYDDY)

- Workhorse (NASDAQ: WKHS)

- Electrameccanica (NASDAQ: SOLO)

- Fisker (NYSE: FSR)

- Arcimoto (NASDAQ: FUV)

- Canoo (NASDAQ: GOEV)

- Lucid Motors (NYSE: CCIV)

- Kandi (NASDAQ: KNDI)

- Arrival (NASDAQ: CIIC)

- Ideanomics (NASDAQ: IDEX)

- Tata Motors (NYSE: TTM)

- Proterra (NASDAQ: ACTC)

Tesla (TSLA)

When it comes to EVs, Tesla is currently the undisputed king of the electic car boom.

Last year alone, Tesla stock soared over 700% and joined the S&P 500 after 5 consecutive quarters of positive earnings.

The clear leader in electric cars with a $800 billion market cap and projected 750,000 deliveries in 2021.

CEO Elon Musk is currently the 2nd richest person in the world and grew Tesla into a massive company over the last decade.

Tesla is planning the Cybertruck in 2022 and currently has over 600,000 preorders!

Source: BusinessInsider.com

Source: BusinessInsider.com

Tesla bulls speculate that the company could also launch robot & air taxis to increase income further.

Tesla is also one of the few companies to add Bitcoin to its balance sheet. Tesla purchased $1.5 billion in Bitcoin and will accept Bitcoin for future car purchases.

Tesla has already earned a $1 billion profit from its Bitcoin purchase and could attract new crypto investors to its already massive cult following.

Not only does Tesla have plenty of revenue upside, but Tesla stock will gain in value as Bitcoin rises over time.

While I don’t think Tesla will soar another 700% in 2021, there is still 2x to 3x upside left in the stock.

TSLA Stock Rating: Strong Buy

Nio (NIO)

Nio ES8 SUV Model

Nio ES8 SUV Model

Nio is a robust Chinese EV maker with an intense focus on technology just like Tesla.

The company allows customers to purchase EVs using a battery swap technology that saves thousands by lettign customers “replace” batteries at any time.

Nio has delivered over 88,000 cars since its inception and is growing in market share throughout China.

The company has lots of long term potential and a smart CEO.

China is the world’s largest EV market and Nio deliveries have increased gradually every month.

In 2020 alone, Nio delivered 42,278 cars with a record 17,353 in Q4 2020 alone.

With a $80 billion market cap, many investors probably think most of the growth is done but Tesla is an example of how a company can continue to grow even with a high valuation.

Nio Stock Rating: Buy

Xpeng (XPEV)

Xpeng recently went IPO in August 2020 and deliveried 8,000 vehicles in the most recent Q3. Many Chinese car experts says it’s the best overall luxury sedan in China. Lots of growth potential in Europe, too.

BYD (BYDDY)

Berkshire Hathaway has a major stake in the company and BYD is a diversified solar company, not just cars. Strong buy.

Workhouse (NASDAQ: WKHS)

Workhorse C-1000 Electric Delivery Van (Source)

Workhorse C-1000 Electric Delivery Van (Source)

Workhorse is off to a rough start in 2021 after missing out on the lucrative USPS contract. The company plans to meet with USPS to reconsider missing out on the deal.

Workhorse has 8,000 vehicles in its backlog but 2020 revenue was only just over $1 million.

After a major selloff due to losing out on the USPS deal initially, WKHS stock fell over 50% with strong support at around $15.

Workhorse offers an amazing electric delivery van with last mile delivery drone that will become the future of package delivery.

What’s also interesting is that Workhorse reported nearly $330 million in income during Q4 2020 because of its 10% stake in Lordstown Motors (RIDE).

Of course, investors are betting on future growth and the stock is selling at a premium but looks attractive.

We’ll see how the meeting with the USPS goes but right now Workhorse is a HOLD.

Electrameccanica (SOLO)

SOLO EV

SOLO EV

The first SOLO EV hit American shores in Q3 2020 and the company has over 75,000 preorders for its flagship, SOLO.

The stock is on a recent tear and is still under a $1 billion market cap.

Many people give funny looks when seeing a SOLO for the first time but it drives just like a regular car.

The SOLO reaches a top speed of 80 mph and has a charge range of 100 miles.

Many test drivers are skeptical at first but end up enjoying their first ride in a SOLO.

From Youtube to news articles, test drivers love the SOLO driving experience although it’s not a great vehicle for driving in snowy conditions.

The SOLO will disrupt the EV market because it’s a single seated vehicle. Many people want a motorcycle-like vehicle with superior safety and protection from rainfall.

Electrameccanica will deliver its first SOLO preorders in mid-2021 and the company plans to build its own US factory in either Phoenix (AZ) or Nashville (TN).

The company is focusing on the West Coast USA but will expand across North America in the future.

Once SOLO deliveries ramp up, I expect SOLO stock to soar in value as more people embrace a smaller, more economical 3-wheeled vehicle.

Fisker (FSR)

Luxury car designer Henrik Fisker makes a 2nd attempt at competing with Tesla with the recent SPAC-IPO.

The Fisker Ocean has 7,000 preorders and the company projects over $12 billion in revenue by 2025.

Arcimoto (FUV)

The 3 wheeled FUV (Fun Utility Vehicle) is another futuristic vehicle that aims to capture a niche EV market.

The FUV is also available for police & firefighters under a different model to improve emergency response times.

Canoo (NASDAQ: GOEV)

Canoo aims to revolutionize transportation by creating a vehicle that’s perfect for the self-driving wave.

Lucid Motors (CCIV)

Lucid Motors is like the “Mercedes of EVs” as the company plans to launch its flagship car this year, Lucid Air.

There is a ton of hype about this company but no one is 100% sure about which SPAC Lucid Motors will merger with.

Rumors suggest CCIV will be the most likely SPAC to merger with Lucid Motors this year.

Kandi (NASDAQ: KNDI)

Kandi is a Chinese EV maker that sells one of the cheapest EVs in America. Kandi’s k27 and k23 are low budget and affordable electric cars that may sell well through North America.

While KNDI stock is still a speculative EV play, I think there is a ton of upside if Kandi can scale its productions while keeping costs low.

Kandi is one of my favorite cheap EV stocks under $10 that could soar in the future.

FAQ

Are EV stocks overvalued?

I believe EV stocks are ready to soar in 2021 after a temporary selloff in early 2021. Some investors bought at the top of EV boom and may wonder if EV stocks are overvalued. In my opinion, EV stocks have a lot of future growth priced in but that doesn’t make them overvalued if you plan to hold for at least a few years.

I value EV companies using P/S ratios to determine how many years of revenue I’m paying for. This is a simple way to compare Tesla vs Fisker using an apples to apples comparison. The EV industry is a high growth industry that’s currently in the early stages but we will see massive EV adoption by 2025 and beyond.

I believe many high quality EV stocks like Tesla, Lucid Motors, Fisker, and Electrameccacina trade at excellent values to their long term growth prospects.

Are EV stocks in a bubble?

EV stocks approached bubble territory in February 2021 but have cooled off a lot since then. Stock market bubbles cause high stock prices that are fueled by greed instead of underlying fundamentals. I understand that investors are excited about this new technology but it’s better to buy EV stocks when they aren’t popular to buy shares at the best prices.

The funny thing is most EV stocks will trade at much higher prices in 2022 so I wouldn’t panic if you bought at the top of the “EV bubble”. Long term thinking means you are willing to buy quality companies and wait until your bullish thesis plays out. Don’t panic because EV adoption isn’t going away and will only accelerate as we embrace a new generation of “smart cars”.