Why XRP is better than Bitcoin: 5 facts about Ripple

The cryptocurrency company Ripple offers banks special technologies with which they can provide cross-border payments at a speed not available to traditional payment systems. XRP digital currency is available on most large exchanges and gives a good profit if you use automated trading. Today’s giants of the banking industry, such as SWIFT and Western Union, are considered Ripple’s competitors. However, these organizations do not use blockchain, therefore their technologies seem to be somewhat behind the times. Today, Ripple successfully works with many financial institutions. The network of this cryptocurrency company consists of more than 200 banks.

What does Ripple offers to banks? – An effective network for the transfer of large assets. Everything happens almost instantly, commissions for transfers on the cryptocurrency company’s network are really low. The Ripple network allows you to reduce the number of currency conversions when transferring from one country to another. So, in a transaction from South Korea to Brazil by traditional methods, through banks, you will have to pay a substantial commission and lose on currency conversions. All this can be avoided if you use the international Ripple network. You can exchange Korean won for XRP, transfer them almost for free to another country, for example, to Brazil, and exchange XRP for local currency there. In other words, XRP is a currency that is used as an intermediary to reduce the cost of cross-border transfers.

All that was said above does not mean that Ripple is a unique technology that cannot be replaced. Firstly, other cryptocurrencies also allow you to make cheaper transfers from one country to another. Secondly, large banks themselves gradually master the blockchain and create their own digital currencies. Not so long ago, financial giant JPMorgan announced the creation of its digital currency JPM for domestic use. Some experts even announced that this move by the largest US bank marks the “beginning of the end” of the entire Ripple payment network. After all, JPM, which relies on the power of the American banking system, is a powerful competitor to XRP.

On the other hand, while instant transition technologies are developing, Ripple has a great chance to take its place in the sun. What the company’s management is doing is luring more and more new customers into its payment network, developing various technological “buns” that should help the company withstand competition with JPMorgan and other financial sharks.

At the same time, today you can buy XRP without any problems and use this digital currency for auto trading on any suitable exchange.

1. Why banks are switching to XRP

Many banks and financial institutions prefer to use the Ripple network to make cross-border transfers for one simple reason: in this network everything is much cheaper than that of competitors. Typically, small banks use intermediary services to transfer funds to another bank. For example, the service of the already mentioned organization SWIFT. But the latter takes quite large commissions for transactions. The system itself is very cumbersome, aimed at servicing large banks, including the Central banks of the largest states of the world. It is clear that for small financial institutions this system is not very suitable. This is where the company Ripple with its cryptocurrency network appears.

Today, more than 200 banks use this network to make transfers. Among the most notable financial institutions there are Santander, Yes Bank, Union Credit, and NBAD. Ripple experts say that the company’s customers can save almost $4 on each transaction on the network. Considering that banks make millions of operations every year, a huge amount is accumulating – up to $10 million!

So, banks choose Ripple purely for pragmatic reasons. The Ripple company provides them with technology that saves them money and speeds up the business. The future of the global economy is behind low-cost fast translation networks.

Today, Ripple’s successful business is led by Brad Garlinghouse. David Schwartz is responsible for innovation sector. The Ripple development team is constantly creative and comes up with new ways of distributing its digital currency, and the company’s managers are building partnerships with all new banks. This is why the XRP cryptocurrency has great prospects.

2. What affects the price of XRP

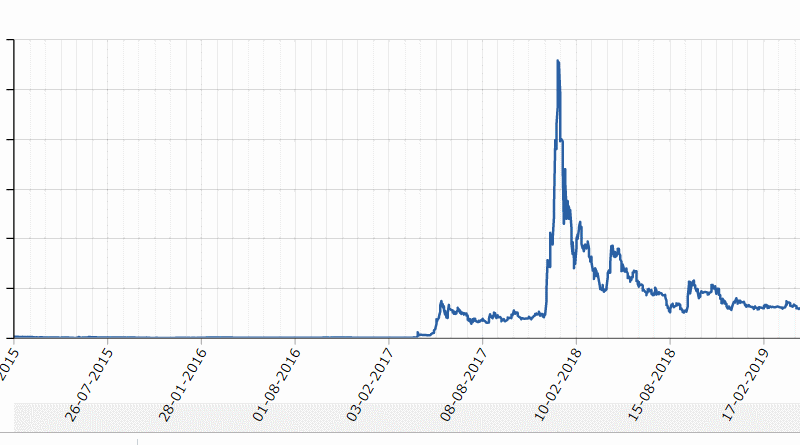

Today, Ripple is largely developing at the expense of institutional investors – companies large enough to invest millions of dollars in it. Ordinary traders cannot make investments in the company, but have the opportunity to buy any amount of XRP. The cryptocurrency has come a long way. Its rise was observed in early 2018, and now the price of XRP fluctuates around the values of two years ago.

Ripple cryptocurrency shows a certain stability, which can be explained by the growing popularity of the platform among banks. In addition, XRP ranks third in terms of capitalization, second only to Ethereum and Bitcoin. In general, XRP plays an important role in the entire Ripple money transfer system – the role of a “reserve” currency. XRP serves as an intermediary, thanks to which it is possible to make cross-border transfers online very cheaply. The head of the company, Brad Garlinghouse, once said that XRP could become a global reserve currency in the future. But so far this is far. After all, both Bitcoin and the new Facebook cryptocurrency already claim this role. However, the dollar is not going to concede its position to anyone yet.

So, you should not count on the rapid growth of the Ripple network. The company, most likely, realistically evaluates its capabilities and expects normal consistent growth. For this, new banks and financial organizations will be involved in the XRP network. Therefore, the XRP rate is unlikely to change much in the near future. As we said, XRP will remain a stable digital currency.

3. Investing in Ripple

The company is interested in increasing the XRP price to the dollar. After all, Ripple still owns most of the coins. In this sense, the purchase of XRP is a direct investment in the development of the company. On the other hand, as we said above, many companies invest in Ripple directly, without buying cryptocurrencies, so it has no problems with free funds that can be invested in business development. That is why XRP has long and solidly become an important component of any investment portfolio. Typically, 15% XRP, 15% Ethereum and 50% Bitcoin are added to the cryptocurrency portfolio, the rest is filled with other promising digital currencies.

How many XRP tokens are there in the world today? – Approximately 100 billion coins, Ripple owns 61% of them. Some investors believe that this is a very dangerous situation, because the company can quickly sell off its stocks and bring down the XRP rate. To reassure all cryptocurrency owners, the company divided its savings into 55 accounts. Only one of the accounts is spent monthly. In this way, Ripple guarantees to investors that the sale of XRP will occur gradually over time.

If we talk about the advantages of XRP, first of all, it should be mentioned its usefulness as an intermediary currency for making bank transfers. Ripple cryptocurrency has real value – banks that connected to the company’s network use XRP to cheapen cross-border transactions. We can say that the global financial system is the guarantor of the stability of this cryptocurrency.

That’s why investing in XRP looks promising: in the future, this cryptocurrency is likely to grow in value, so it will be possible to earn on it much more than by buying shares of large companies. It’s also good to use XRP to make money on fluctuations in the exchange rate – the currency is relatively stable and therefore suitable for auto trading.

4. XRP vs Bitcoin

The question arises – why not invest in Bitcoin instead of XRP? After all, bitcoin is a more popular currency, has a significantly greater capitalization, etc. The answer is simple. Earlier, we talked about how competent investors make up an investment portfolio. Whatever one may say, there should be more Bitcoin in the portfolio than XRP. But investing only in BTC is too unreliable. Bitcoin is unlikely to “die”, but can stagnate for a long time. This is why you need to add XRP to your portfolio. If BTC does not show good results, you can rely on profits from Ripple. Of course, the entire cryptocurrency market can collapse at one point, as it happened in 2018. However, there are no prerequisites for this. Personally, we hope for the best, although you should always remember that investing in digital currencies is a high-risk investment.

Experts name several advantages of XRP over Bitcoin:

- Ripple is a faster and cheaper money transfer network

- “slowdown” cannot occur in the XRP network due to an increase in the number of transactions, which often happens with BTC

- The Ripple network does not need mining, since more than 100 billion coins have already been issued

- XRP is becoming an increasingly decentralized network due to an increase in the number of nodes

- Ripple is actively building partnerships with banks and is part of the global financial system

On the other hand, the disadvantages of the Ripple cryptocurrency cannot be unnoticed. The company has recently focused more and more on working with banks and financial organizations, while forgetting about ordinary people. The main services developed by the company work for large capital.

Above, we noted that the company issued 100 million tokens immediately, so as not to depend on mining. This advantage of the system is at the same time its disadvantage. Ripple owns more than 60% of tokens, so it can instantly bring down the price of XRP or otherwise affect the rate of the coin.

Scientists at Purdue University recently spoke of another problem. They found vulnerabilities on the Ripple network that could be used to crack user accounts.

Nevertheless, Ripple has more positive aspects than negative ones. The company is actively promoting its cryptocurrency as a complete means of everyday payments. Already, many online stores accept XRP. Such sites include TorGuard, Superstore and Coinhost, you can pay with eBay and Amazon with a coin, which is already good. Recently, the company introduced a plugin for WooCommerce, which allows you to connect the Ripple payment system to the store. In this sense, XRP is no different from Bitcoin, for which you can now buy coffee.

5. XRP price Forecasts

Last year in Japan, GMO conducted a survey in which it polled users about the change in the XRP rate by the end of 2019. More than 20 thousand people became respondents. All of them are somehow related to cryptocurrency trading. Half of those surveyed people felt that XRP would grow by the end of the year, while others were more skeptical. Such polls show well the mood of the digital currency market participants.

Another research was conducted by Weiss Ratings. The company’s specialists are sure that if Ripple is at least a little squeezing SWIFT in the interbank transfer market, then XRP can surpass not only Ethereum, but even Bitcoin in terms of capitalization, that is, become the “first cryptocurrency”. However, SWIFT does not give up its positions and even intends to introduce blockchain technologies into its network. So, it is more possible that by the end of 2019 the price of XRP will not change significantly.

Walletinvestor analysts also have given a forecast. They are confident that the price of XRP will even decrease slightly by the end of the year, and only in the middle of next year some growth is possible.

Tradingview also sees no reason for the growth of XRP as part of its technical analysis.

In general, the XRP rate has remained relatively stable lately. It seems it will remain the same until the end of this year. At the same time, the behavior of the Ripple digital currency largely repeats the changes in the bitcoin exchange rate. The XRP rate is still largely dependent on trends in the entire cryptocurrency market, i.e., on the behavior of BTC.

XRP has its own reasons for falling. Competitors may make pressure on the project. If in the near future other networks that provide banks with effective mechanisms for cross-border payments will actively develop, then Ripple’s positions will inevitably wobble, which will affect the XRP rate.

Among the main competitors of Ripple there are Stellar (XLM) and JPM Coin. The XLM project in a sense can be considered a copy of XRP. Stellar has all the advantages of Ripple, but also all the disadvantages. There is no reason to believe that XLM will be able to defeat XRP in the future, but this cannot be ruled out. The emergence of JPM Coin also creates problems. As it was already said above the banking giant JPMorgan created its own cryptocurrency. However, the bank is not going to seriously engage in setting up a cross-border transaction service.

Experts believe that JPM has every chance to “pick up” XRP. So, Joe Weisenthal, a journalist for the Bloomberg American publication, states: “If JPmorgan blockchain technology is effective, that the bank will easily be able to draw the financial system. Then the Ripple business will be destroyed from the face of the earth. “

However, other analysts are sure that the American bank will simply not engage in cryptocurrency business – banks do not need a blockchain at all, since decentralization is not needed.

So, we spoke in detail about the prospects of XRP. Whether or not to invest in this cryptocurrency is up to you. Ripple has all the necessary components for successful development. But a lot, as we know, depends on luck. Let’s see if the third cryptocurrency succeeds in becoming the first or at least stay in place.